30 of the Best Pitch Decks That We’ve Ever Seen

If you’re raising funds, a pitch deck is critical. Here are the 30 best pitch decks and best startup pitch decks our team has ever seen.

Ask The Experts: How Long Should A Business Plan Be?

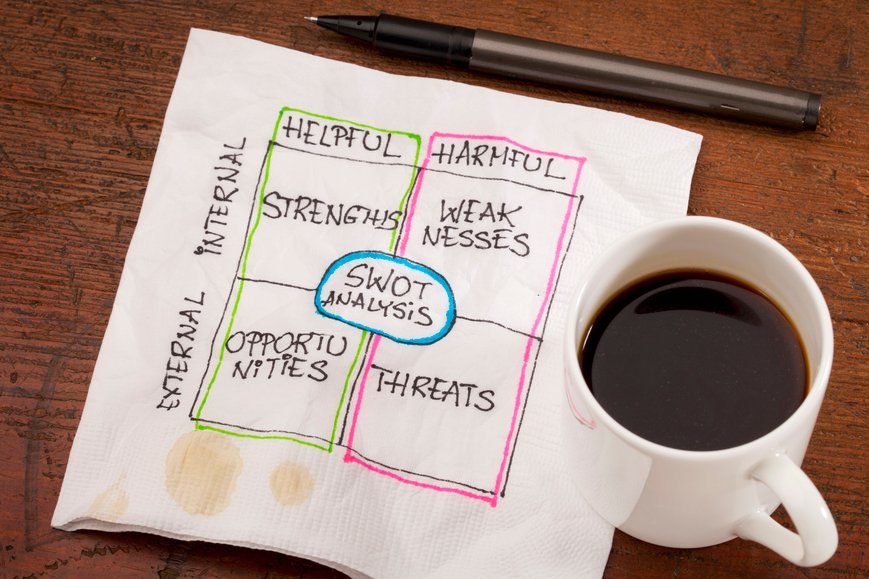

What Is A SWOT Analysis and How To Perform One

Knowing your startup’s strengths, weaknesses, opportunities, and threats is essential to growth. Learn how to perform a SWOT analysis the right way.

9 of the Most Important Slides For An Excellent Pitch Deck

Choosing the right format for your pitch deck is half the battle. These nine slides are essential for any successful pitch deck.

How To Win A Business Plan Contest

Winning a business plan contest can help your business earn funds and establish new business relationships with investors and VCs.

How To Write The Most Effective Executive Summary

Business plans are long and comprehensive documents. Although investors may receive business plans regularly, they actually read very few. You may spend months writing your business plan, but the unfortunate truth is that most investors will only spend a few minutes with a document before deciding whether its an interesting venture or not. The key to getting investors […]

How To Perform A Target Market Analysis For Startups

What Is A SWOT Analysis and How To Perform One

Ask The Experts: How Long Should A Business Plan Be?

9 of the Most Important Slides For An Excellent Pitch Deck