Being turned down by an investor after a startup pitch can be disheartening. You spent weeks creating your pitch deck and practiced your delivery day and night. Even though you gave your startup pitch presentation everything you had, you weren’t able to convince them to invest in your business idea.

Startup pitch failure is not uncommon. Most startup pitches fail, and most founders who walk into an investor meeting with high hopes will walk out without a deal. Any startup that has had success at raising money has likely also experienced many failed pitch presentations.

The bad news is, if you’re seeking funding for your startup, you’ll probably get turned down by the majority of investors that you pitch. The good news is, even if 100 investors turn you down – you only need to convince one to turn your luck around.

Startup teams that get funded are those that are determined and persevere even after a pitch failure – or many pitch failures. When successful startups pitch, there’s no such thing as a failure, because every investor meeting provides a learning opportunity that eventually results in successful fundraising.

The Truth About Startup Pitch Success

With all the rave about multi-million dollar funding rounds and billion-dollar startup acquisitions, it may feel as though everyone is getting funded but you. Don’t let the media fool you, angel and VC funding isn’t as commonplace as it seems.

David Rose, founder of New York Angels and Gust explained, “[Each year] roughly 1,500 startups get funded by venture capitalists in the US, and 50,000 by angel investors. VCs look at around 400 companies for every one in which they invest; angels look at 40.”

Everyone is inspired by the stories of startup founders who were able to generate a huge funding round, but we rarely hear about what it really took for them to get there. Finding the right investor and convincing them to invest can be an intensive, drawn-out experience. A successful startup investor pitch is usually backed by a series of unsuccessful pitches.

Studies by DocSend revealed that companies needed an average of 40 investor meetings over 12 weeks to close a funding round. Twelve weeks might seem like an eternity when your startup is relying on funding to move to the next level, but when it comes to fundraising, patience is a virtue. According to DocSend, companies that failed to successfully raise funds gave up after an average of 6.7 weeks – five weeks shy of being a potential success story.

Why Do Startup Pitches Fail?

There’s one main reason why pitches fail: investors aren’t convinced that the startup will provide a large enough return on investment.

But what’s more important is why they weren’t convinced. This question can be much more difficult to answer. Sometimes the reason won’t be obvious, and usually, it will be due to several factors. First, keep in mind that investors are looking for companies with strong growth and scaling potential that have a good exit strategy. They make money when you sell.

Here are some common reasons investors may decline to invest in a startup after a pitch.

1. Bad Delivery

It’s not always about what is being said; how it’s being said is equally as important. It doesn’t matter that you have a great business model with incredible traction and the ability to scale if you can’t properly convey those qualities in your elevator pitch.

A great business can miss its chance at funding because the founder couldn’t deliver the information properly. Likewise, a so-so business can walk out the door with a deal just because the pitch was executed so well. Practice your pitch. Make sure it’s well organized, and that you’ve done enough research to know who you’re pitching to.

2. Not Enough Traction

Many times, startups are turned down because they simply haven’t proven themselves enough. Ideas mean very little, and what really matters is the execution behind that idea. Almost no investor will fund a startup that hasn’t demonstrated some initial success—meaning sales or users.

You may believe in your startup, but investors believe in the numbers behind the startup. Although your funding resources may be small today, investors want to know that you were able to use those limited resources wisely to prove your concept and secure initial customers.

3. Wrong Investor Fit

Not all investors are the same, and neither are their investment strategies. Some firms and angels prefer to invest in startups in the very early stages, while others invest in later funding rounds. One investor may only invest in tech startups, while another may only partner with innovative hardware startups. One firm may be only interested in solutions for the health industry, while another may be seeking to invest in solutions for the financial industry.

The point is, even if your business is awesome; if it isn’t a good fit for that investor and their portfolio, they simply won’t invest.

4. Inexperienced Team

The strength of the founding team plays a major role in how an investor will perceive your business. Even if the investor believes in the concept and growth strategy, they won’t invest if they believe your team isn’t capable of bringing it to fruition.

5. Underwhelming Pitch

Investors hear startup pitches constantly, and sometimes, one pitch is almost unrecognizable from the next. Your business may have some traction and there may be a market need, but that’s not enough to make it special.

There are many times when great startups get overlooked simply because they weren’t able to stand out and deliver a memorable pitch.

The majority of pitches fall into the “good pitch” category, but only a few are exceptional. Investors want to put their money into something exciting, and the best time to win their enthusiasm is during the initial pitch. An exceptional startup pitch is unforgettable. Even if an investor heard 25 pitches that day, it’s only the phenomenal few that will stand a chance for a deal.

Failing Your Way To Funding Success

In all likelihood, you will go through several failed pitches on your journey to securing an investment deal. Fortunately, whether you walk away with an investment or not, every opportunity to pitch your business to an investor has the potential to move you one step closer to your ultimate goal.

Each time you pitch your business, you should learn something new that improves your chances the next time around. If the only thing you took from your meeting was “no,” then you were listening for all the wrong things!

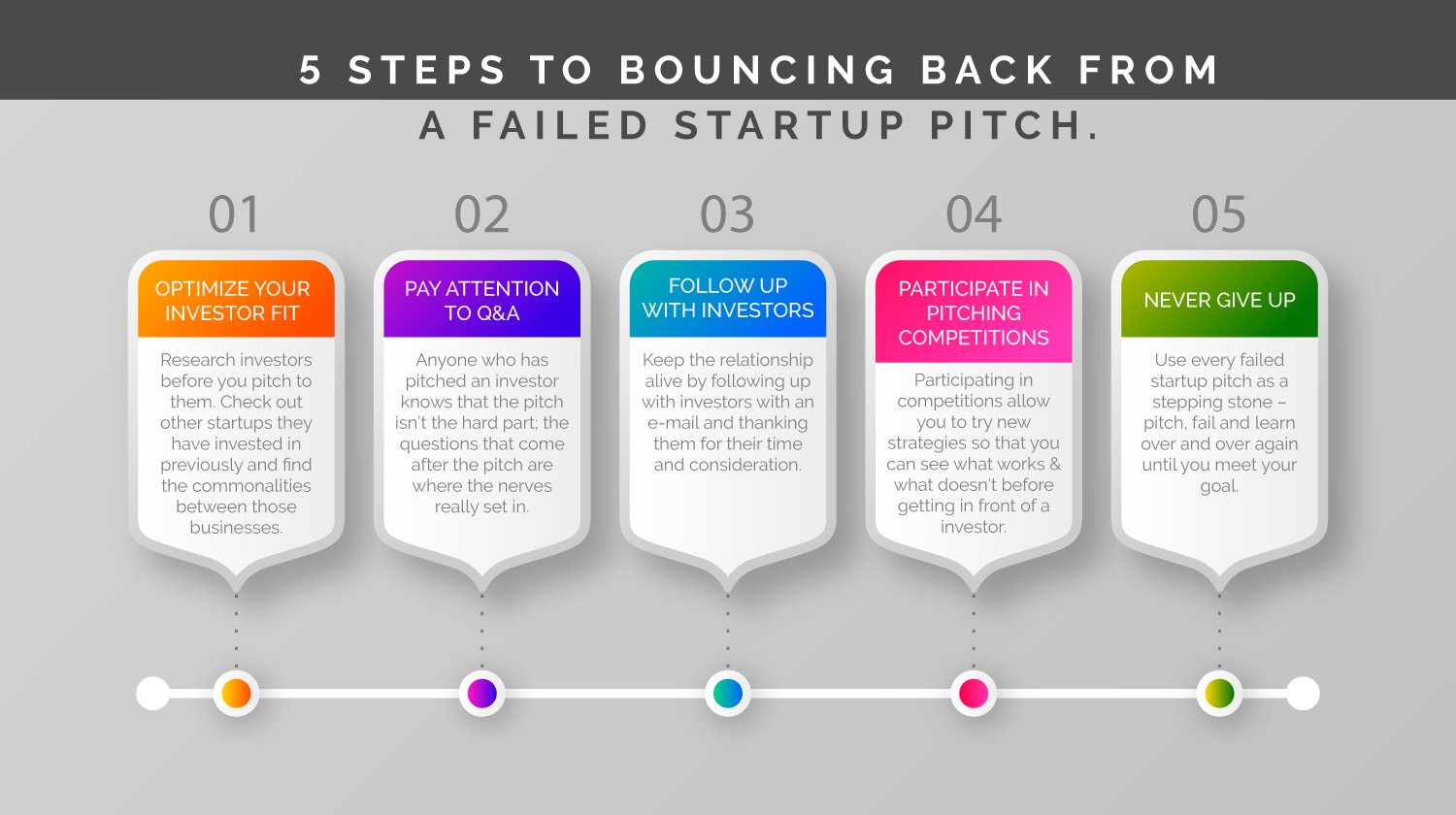

Here are 5 steps to bouncing back from a failed startup pitch.

1. Optimize Your Investor Fit

Pitching doesn’t only give investors the opportunity to learn more about startups, it also gives startups the opportunity to learn more about investors. View every investor meeting as a chance to identify what type of investors are most receptive to your pitch, and what type of investors quickly write you off.

You may find, for instance, that angel investors you speak with are eager to hear more, while the VC firms you’ve pitched showed no interest. Or, you may find out that general investors weren’t able to understand the scalability of your high-tech software, while tech investors caught on to the concept immediately. Identifying the best type of investor to approach can drastically increase your potential for funding success and minimize the chances of pitching your startup to the wrong audience.

Research investors before you pitch to them. Check out other startups they have invested in previously and find the commonalities between those businesses. If the qualities of your startup are considerably different, this may be a clear sign that your startup won’t be the best fit for their portfolio. Conversely, if your startup aligns with the qualities of their previous investments, you have a much greater chance of securing their interest.

2. Pay Attention To Q&A

Anyone who has pitched an investor knows that the pitch isn’t the hard part; the questions that come after the pitch are where the nerves really set in.

You’ve practiced your pitch 1,000 times. You know exactly what you’ll say and when you’re going to say it. You’ve studied all the best pitch decks, and you’ve created one that exceeds the standard. You know what to say, when to say it and exactly when to click to the next slide. What you don’t know is what investors are going to ask you after the pitch is finished. If you aren’t prepared to answer these questions, you will quickly lose their interest.

These questions don’t only give investors better insight, but they can also help you identify weaknesses in your startup pitch. Whatever the question may be, the investor thought it was important enough to ask but didn’t find the answer in the pitch itself.

Remember the questions that they asked and use them to strengthen your pitch the next time around. As you pitch and fail more and more, you will be able to continually optimize your pitch. Each time, you will be able to better convey the information that investors find most important.

3. Follow Up With Investors

Don’t allow a “no” be the end of your relationship with the investors that you have pitched. A “no” today can be a “yes” a year from now. Keep the relationship alive by following up with investors with an e-mail and thanking them for their time and consideration.

If they already passed on making a deal with you, email them and politely ask if they can give you a few pointers on how your pitch can be improved. Not every investor will give you a reply, but the ones who do can provide you with insights that can be extremely helpful when pitching again in the future.

4. Participate in Pitching Competitions

Pitching more means generating more feedback, which ultimately leads to a better-optimized pitch. Before you can give your best startup pitch ever, you’ll likely give your worst startup pitch ever. Startup funding is a numbers game, and the more you do it, the higher your potential for success becomes. As you make changes to your pitch, take advantage of opportunities to test it out before going into another investor meeting.

Pitch competitions are an incredible way to test new pitching ideas and generate more feedback. There are often cash prizes associated with winning a pitch deck competition, and they can also open the door to new investor relationships. Participating in these competitions allow you to try new strategies so that you can see what works and what doesn’t before getting in front of a potential investor.

5. Never Give Up

Even when it seems that you will never meet your funding goal, keep pushing forward. You never know just how many investor meetings it will take until you get funded. Your next pitch may be the one that succeeds!

Use every failed startup pitch as a stepping stone – pitch, fail and learn over and over again until you meet your goal. Walking away without a deal can feel like the end of the world, and you may go through this experience multiple times.

Always remember, the day you walk away with your first deal, you will appreciate the lessons you learned during each and every failed pitch. It doesn’t matter how many times you fall, only how many times you get up!

If you’re seeking startup funding, you’ll need a great pitch deck. Check out one of our sample pitch decks and contact us today to speak with one of our expert consultants!